While rapid growth is often considered the holy grail of success, one company in the San Fernando Valley is challenging the norm. Liberty Company Insurance Brokers Inc. has been on a meteoric rise, but it is making the decision to deliberately put the brakes on its expansion.

Why would a company want to slow down if it’s thriving in the competitive business landscape? The answer lies in its pursuit of long-term success and desire to ensure its operations and teams are prepared to execute sustainable growth.

Liberty is the No. 1 company on the Business Journal’s List of Fastest Growing Companies for the second year in a row and reported 268% revenue growth from 2020 through 2022.

The Woodland Hills-based company posted $149 million in revenue last year – up 177% from the year before – and said it’s on track to reach $200 million this year. In addition to revenue, the company has also accelerated its hiring. Liberty brought on 550 employees from 2020 to 2022, and has a current headcount of 835.

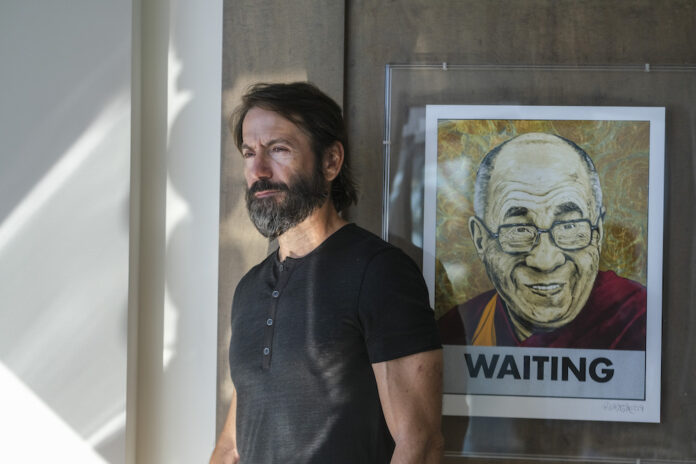

Liberty founder and chief executive Bill Johnson said that the company is now stopping for breath to ensure its operations are prepared to handle the ongoing business boom.

“I think as an organization gets bigger, sometimes you outgrow certain leaders, certain systems, and processes and procedures need to be buttoned down or changed because of because of the size that you have become,” Johnson said.

A 2002 study from California Polytechnical University found that companies with moderate growth in earnings had higher rates of return and value creation for their owners; it also found that a level of growth above a certain point could adversely impact profitability. Dan Wadhwani, a professor of clinical entrepreneurship at the USC Marshall School of Business, said that growing too quickly can result in issues such as hiring less-than-ideal employees or being unable to properly serve customers.

“In a competitive landscape, we almost automatically associate growth with success, but you can grow yourself to death,” Wadhwani said. “In situations of really rapid growth … the quality of your service can decline, and the reputation can decline, so that’s a very clear situation where that can be actually a risk to the company.”

For Liberty, development has also been driven by mergers and acquisitions. And this activity is being purposely slowed down: Liberty closed 73 mergers and acquisitions between 2021 and last year, and has completed only three acquisitions this year. It most recently acquired Ohio-based Farley-Peeples Insurance, doing so last month.

Johnson said the company has become more selective and opportunistic about the value a potential acquisition could add to Liberty’s operations, and that the interest rate environment has changed the economics around mergers and acquisitions.

“We want to feel comfortable that we can buy an asset and add value and make it more valuable, and some of the systems that we have been putting in place this year were increasing our ability to do that,” Johnson said.

The company is specifically working to “button down” its system for integrating a new acquisition, such as financial accounting operations, business relationship management and licensing.

George Abe, an associate professor of entrepreneurship at the UCLA Anderson School, said that not having the proper systems in place to manage the small details and moving parts of an acquisition or merger can be disastrous.

“The majority of failed mergers are because of failed integration, not because the deal was wrong,” Abe said. “Usually, the seller and the buyer can agree on the right price, but the integration piece, and making sure the right people don’t quit, is a real problem.”

A career detour

Johnson stepped down as chief executive of the company in 2003 to explore a career in film production. After serving as executive producer on movies including “The Grey” and “Killing Them Softly” and as a producer on “Minamata” and “Just Friends,” Johnson returned to Liberty in 2018. The company has grown its team and coverage areas since his return.

Liberty’s coverage areas as a private broker can be tied to having someone on its team with talent or expertise in that area. Its coverage areas include broader industries such as construction and commercial auto, as well as more specialized sectors like equipment and party rentals, cannabis, live-event contractors and landscaping.

“I always say, it’s better to go 3 miles deep than to go 3 miles wide,” Johnson said. “To have a real niche of expertise where people are coming to you because you become so knowledgeable in that particular arena, you understand their business very well (and) you have relationships with strategic partners in the industry.”

Company culture

Johnson said that the company’s remote work-friendly structure has provided flexibility and allowed Liberty to acquire new talent around the country, including individuals who may have been otherwise inaccessible. In the process of taking a break from its exponential growth, Johnson said he’s working to establish mentorship and training programs for its team.

Abe said that providing a clear path for career development has become increasingly important for retaining employees. It’s a “big deal” to develop a positive corporate culture, he said, and a lack of it can lead to staff turnover and a loss in morale. When looking to attract and maintain employees it is “patently important,” Wadhwani said, to offer quality opportunities for employee growth.

“It’s important and valuable in itself to feel like you’re doing the right things by your employees and maintaining a quality culture internally,” Wadhwani said, “Also, the competition for talent is really high … and bringing in new employees, and searching for new employees, is really expensive. There’s that business case to make it a really good environment as well, in order to cost effectively keep employees that are good.”

Johnson said that when he returned to Liberty one of his goals was to develop a positive culture for the company’s team. He said that talent development is a crucial part of organic growth, and that being able to attract new talent also brings in new customers and revenue.

“I came back into the business with the intention of creating a special culture and a special environment where it would be in service to helping our people be healthier and happier and providing a platform for them to pursue their entrepreneurial dreams,” Johnson said. “We’re a service business and it’s all about relationships, so the real asset that drives the value in our business is our people.”