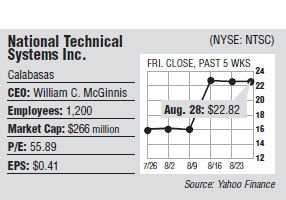

The San Fernando Valley is set to lose another of its public companies. After a year in which its stock has performed strongly, National Technical Systems Inc. has agreed to sell itself to a Los Angeles private investment firm in a deal valued at $267 million. Aurora Capital Group has offered $23 per share in cash for the Calabasas company, a 39 percent premium over the closing price at the time of the offer. The company’s stock has skyrocketed since then, closing at $22.82 on Aug. 28. National Technical provides testing and engineering services for the aerospace, defense and transportation industries at facilities throughout the United States, including a 150 acre site in Santa Clarita. Jessy Cavazos, director of test and measurement at Mountain View research and consulting firm Frost & Sullivan, said one reason Aurora might have found National Technical attractive is because it’s the No. 2 player in the emerging field of electromagnetic compatibility testing, which ensures devices with electromagnetic pulses do not interfere with each other. “They are one of the key players in the North American space,” she said. “And the overall market for these services is growing.” National Technical has appointed a special committee to review the acquisition and plans to have a special shareholders meeting to approve the deal next month. The companies expect the sale to close before the end of the year and for the existing staff and management to remain in place. National Technical declined to comment on the acquisition, but in a statement, founder and Vice Chairman Aaron Cohen said the sale will help with company expansion. “It will allow NTS and our employees to continue to grow and excel as the preeminent independent testing and engineering services organization in North America,” he said. “With Aurora as a partner, I believe the company’s potential is limitless.” National Technical has closed several major contracts this year, including one to design and build test equipment for components used on the Airbus A350 passenger jet. And in a cost-cutting maneuver, the company announced an unspecified number of layoffs in May as it centralized administrative functions. At the time, it projected annual savings of $5 million to $6 million. That helped the company produce a strong fiscal first quarter, with earnings per share of 12 cents. Share prices were up about 120 percent this year prior to the sale. This is not Aurora’s first foray into the defense and manufacturing sectors, as it previously had investments in RBC Bearings Inc., an Oxford, Conn. manufacturer of ball bearings and K & F Industries, a manufacturer of aircraft wheels, brakes, and brake control systems that was later bought by Meggitt Plc of Christchurch, England. Aurora did not return calls for comment. The company has invested more than $2 billon into more than 100 companies since its founding in 1991. Its current portfolio of companies has combined revenue of more than $1.5 billion.