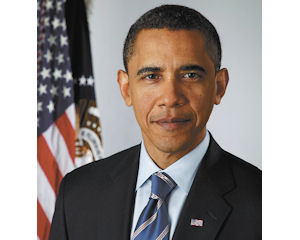

Tax professionals are treading in difficult waters these days, doing their best to advise clients wisely while Congress hasn’t decided yet how to address the tax cuts from the George W. Bush administration. Enacted in 2001 and 2003, the tax cuts are set to expire at the end of 2010 altering numerous tax rules and increasing rates on many types of income. “I think the word now is uncertainty,” said Don Dahl, Southern California Tax Practice leader for Grant Thornton. “I think what’s most challenging right now is trying to predict what’s going to happen. It really is a waiting game.” If no legislative action is taken the top capital gains rate will increase from 15 percent to 20 percent; dividend taxes will go from a top rate of 15 percent to a rate of 39.6 percent and the top marginal income rate will increase from 35 percent to 39.6 percent, among other increases. “So even if nothing happens there’s going to be huge changes,” Dahl said. Uncertainty over the controversial federal estate tax – known by its foes as the death tax- is very problematic according to some accountants and may put families in a difficult situation if faced with a sudden death. “That’s a huge fiasco Congress has created, people are waiting to see what’s going to happen but if an unfortunate event happens to a client, they may have a big problem,” said Calvin Hedman, president and partner of CPA firm Hedman Partners. No tax in 2010 The last estate tax legislation was passed back in 2001 and called for a gradual reduction in the estate tax each year until December 2009; then no estate tax at all in 2010, followed by a return to 2001 rates in 2011. The general assumption was that Congress would come to an agreement about an estate tax rate before letting it get down to zero in 2010. “I would have sat here a year ago and said, ‘they are not going to allow to have a year where there’s no estate tax’; and at the beginning of the year I said ‘we’re going to get half way through the year and they are going to change the rules retroactive to the beginning of the year’; but here we are and it’s already September and they haven’t touched any of the estate tax rules. So that has created a level of uncertainty which has made it difficult to plan for clients,” Dahl said. The estate tax rate is set to come roaring back in 2011, going from zero to 55 percent for most estates. The amount of the estate that is exempted from taxation would come down from $3.5 million in 2009 to $1 million in 2011. “With estate taxes right now we’re in a waiting pattern, we hear that something is going to get done, it’s not just going to go away, they’re not just going to accept the repeal of estate taxes completely, so we’re planning from that point of view,” said Michael Kaplan, partner at Miller, Kaplan Arase and Co. “We’re taking a conservative outlook and saying ‘well, if we can extend the filing period then we’ll see what happens in terms of legislation.” According to Kaplan, it’s likely that Congress will approve estate tax rules similar to what was in place in 2009, while keeping the $3.5 million exemption. Influencing decisions Uncertainty surrounding taxes is already coloring business decisions. Larry Haworth, partner with the firm Bessolo Haworth & Vogel LLP in Sherman Oaks, said there’s already talk of clients looking to accelerate income to take advantage of this year’s tax rates. “For the first time in quite a while clients are considering accelerating their income which is very unusual, they typically look to defer it,” he said. Clients may accelerate income through a myriad of avenues including cash bonus programs, stock options and retirement plan distributions among others. Some companies are even considering whether to accelerate payment of certain compensation for key employees into the 2010 tax year to help those employees take advantage of lower income tax rates. When it comes to estate planning, some accountants anticipate a boost in “gifting” (a way to reduce taxes by reducing the size of your estate). “I’ve not seen gifting taking place yet, but I will tell you in the last 60 days of the year we’re contemplating with some of our clients that we’ll be doing some gifting,” Dahl said. In the midst of so much uncertainty one thing is for sure: accountants are going to be very busy the last months of the year. “We predict over the next 60 to 90 days that our clients are going to want to do proactive tax planning, probably more so than any year in the last ten years because of the changes that are inevitable,” Dahl said. “We see this as a good thing for public accounting because people are going to want to meet with us, they’re going to want to understand where we are in Congress, and they want to be positioned to make the decisions they are going to have to make in the last couple weeks in December either way. This is a good thing for tax professionals.” Dueling Proposals Conservative Congressional Republican leaders are locked in a standoff with President Obama over the fate of tax cuts enacted in 2001 and 2003 during the Bush administration. Those cuts, scheduled to expire at the end of this year unless Congress acts, lowered taxes for all taxpayers but also helped to drive the federal deficit to record levels. Conservative Republicans believe all of the 2001 and 2003 tax cuts should be extended. The Obama administration and congressional Democrats have said they would support extending tax cuts for individuals making up to $200,000 and couples earning up to $250,000. Some House Democrats are calling for a one-year extension of the upper income tax cuts as well as a permanent extension of the middle class tax cuts. A group of GOP senators is proposing to extend all the Bush cuts for two years arguing that would give the economy time to improve and Congress a window to tackle tax reform as part of a broader effort to restore the country to fiscal health. The NumbersExpiration of Bush Tax Cuts Would Impact Income-tax Rates Current Marginal Rate Income Range Rate in 2011 (married filing jointly) If tax cuts expire 10% up to $16,750 15% $16,751- $68,00 15% $68,001- $137,300 28% $137,301- $209,250 31% $209,251 – $373,650 36% Over $373,650 39.6% * Source: Tax Policy Center