The first quarter wasn’t an easy one for the North Los Angeles office market. The area, which includes the San Fernando Valley, Burbank and Glendale, largely saw vacancy rates continue to climb.

The industrial market also saw vacancy rates tick upward, although most submarkets are still under 1% vacancy, resulting in an incredibly tight market.

This Special Report looks at how the office and industrial markets fared in the first quarter.

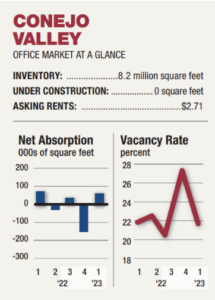

Conejo Valley

Tenants in the Conejo Valley took 61,167 square feet of space. Vacancy rates, meanwhile, fell to 21.8%, down from 22.6% the previous quarter. Asking rents were $2.71 a square foot, down 3 cents quarter over quarter and 2 cents year over year.

Main Events:

Main Events:

A 98,776-square-foot office building in Thousand Oaks sold for $17.8 million. CBRE Group Inc.’s Mike Longo, Sean Sullivan and Todd Tydlaska represented the seller in the transaction. CBRE’s Greg Grant facilitated $42 million in financing for the building’s acquisition and speculative conversion into a life sciences campus on behalf of the buyer, San Francisco-based Graymark Capital. The property, which was built in 1998, is located at 120 Via Merida.

The Agoura Oaks Medical Center One at 28222 Agoura Rd. in Agoura sold for $3.8 million. An undisclosed buyer purchased the center from Pacgenomics. The 14,5650-square-foot property was built in 1981.

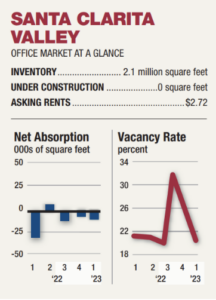

Santa Clarita Valley

Office vacancy during the first quarter increased to 20.4%, up from 20% the previous quarter but down from 20.8% the previous year. Asking rents held steady quarter over quarter at $2.72 a square foot but rose 4 cents year over year.

Main Events:

Main Events:

- A roughly 300,000-square-foot warehouse at 25655 Springbrook Ave. in Santa Clarita was leased by Scenic Expressions with landlord Covington Group Inc. Scenic Expressions is an entertainment company. The property, known as Saugus Station Industrial Center, is a 69.5-acre, 975,300-square-foot property.

- Three office properties totaling 195,387 square feet at 28490 Avenue Stanford in Santa Clarita were bought by Vallarta Supermarkets Inc. from True North Management Group. Vallarta Supermarkets plans to move its headquarters from Sylmar to the area. With the move, Vallarta is expected to add about 220 jobs to the Santa Clarita Valley economy.

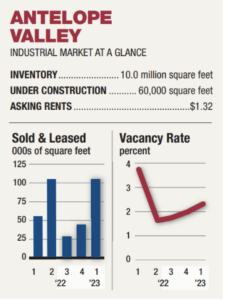

Antelope Valley

A total of 104,619 square feet of industrial space was sold or leased in the High Desert during the fourth quarter. The vacancy rate was 2.3%, up from 2% the previous quarter but down from 2.6% the previous year. Asking rents increased 2 cents quarter over quarter and 12 cents year over year to $1.32 a square foot.

Main Events:

Main Events:

- Boyd Watterson Asset Management LLC purchased a 58,104-square-foot office building at 39115 Trade Center Dr. in Palmdale for $21.5 million. Catalyst Real Estate was the seller.

- A portion of the Palmdale Marketplace, in Palmdale, sold for $5.4 million. It is a 12,000-square-foot, full leased asset and is 100% occupied. Its tenants include Jenny Craig and Verizon. SRS Real Estate Partners has broken the Palmdale Marketplace up into a number of parcels which sold separately.

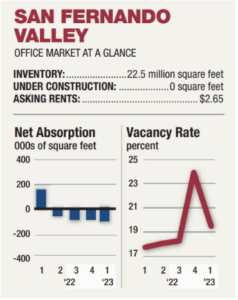

San Fernando Valley

Office tenants gave back more than 68,000 square feet during the first quarter. The vacancy rate rose to 19.3%, up from 19%the previous quarter and 17.3% the previous year. Asking rents fell 2 cents quarter over quarter and year over year to $2.65 a square foot. In the industrial market, the vacancy rate was a mere 0.6%.

Main Events:

- Haven Warner Center, a 205-unit multifamily property at Warner Center, sold for $54 million, or $263,415 per unit.

- Griffin Plaza, an 85,022-square-foot grocery- and drug-anchored retail center located at 3885-3977 Cochran St. in Simi Valley, sold for $22.1 million.

- Golden Bee Properties purchased Mountain View Manor, a 200-unit apartment building in Sylmar, for $39.5 million.

- Victory Plaza, a 136,580-square-foot, grocery-anchored retail center in North Hollywood, sold for $57.8 million. The buyer was Gerrity, a real estate investment company based in San Diego. Located at 13007-13047 Victory Boulevard, Victory Plaza is situated on 12.2 acres of land and is anchored by Vallarta Supermarkets.

A rare Sun Valley development site situated on 6.9 acres sold for $40 million. The buyer, Epicenter Landcorp, acquired the asset at 11660 Tuxford St. Colliers’ North Los Angeles industrial agents David Harding, Greg Geraci, Matt Dierckman and Billy Walk brokered the deal on behalf of the buyer. Brad Luster of Major Properties represented the undisclosed seller.

A rare Sun Valley development site situated on 6.9 acres sold for $40 million. The buyer, Epicenter Landcorp, acquired the asset at 11660 Tuxford St. Colliers’ North Los Angeles industrial agents David Harding, Greg Geraci, Matt Dierckman and Billy Walk brokered the deal on behalf of the buyer. Brad Luster of Major Properties represented the undisclosed seller.- A mixed-use property at 3611 Cahuenga Blvd. in Studio City sold for $2.9 million or approximately $437 per square foot.

- A mixed-use development site at 6036 Variel Ave. in Woodland Hills sold for $7.2 million, or $137 per square foot. CBRE Group Inc.’s Laurie Lustig-Bower and Kamran Paydar represented the seller, a private investor, in the sale. The property was purchased by a joint venture of Lyon Living, Paloma Communities and Urban Stearns.

- Boyd Watterson Asset Management LLC purchased a 61,600-square-foot office tower at 21041 Warner Center Ln. in Woodland Hills for $20.8 million from Adler Realty Investments.

- A 26,000-square-foot industrial building at 15950-15952 Strathern St. in Van Nuys sold for $7.1 million.

Burbank and Glendale

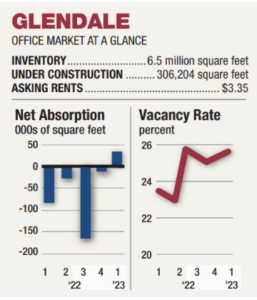

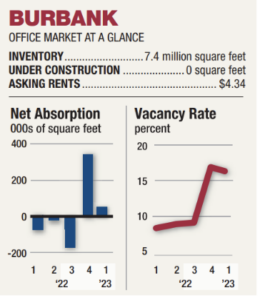

Burbank and Glendale saw more than 82,000 square feet absorbed into the office market. The vacancy rate in Burbank fell to 15.9%, down from 16.4% the previous quarter but up from 8.2% the previous year. The vacancy rate in Glendale rose  to 25.5%, up from 25.3% the previous quarter and 23.8% the previous year. In Burbank, the asking rent was $4.34 a square foot, down 6 cents over the previous quarter but up 7 cents over the previous year. In Glendale, the asking rent was $3.35 a square foot, up 3 cents over the previous quarter and 13 cents over the previous year.

to 25.5%, up from 25.3% the previous quarter and 23.8% the previous year. In Burbank, the asking rent was $4.34 a square foot, down 6 cents over the previous quarter but up 7 cents over the previous year. In Glendale, the asking rent was $3.35 a square foot, up 3 cents over the previous quarter and 13 cents over the previous year.

Main Events:

- A 127,140-square-foot office building at 2777 N. Ontario St. in Burbank sold for $37 million. Montana Avenue Capital Partners LLC bought the property from Washington Capital Management Inc.

Law Offices of Stephenson, Acquisto, & Colman signed a lease with Granite Properties for 10,591 square feet at 500 N Brand Blvd. in Glendale. Both the law firm and the landlord was represented by Jones Lang LaSalle Inc. in the lease.

Law Offices of Stephenson, Acquisto, & Colman signed a lease with Granite Properties for 10,591 square feet at 500 N Brand Blvd. in Glendale. Both the law firm and the landlord was represented by Jones Lang LaSalle Inc. in the lease.- A retail center at 725 S. Glendale Ave. in Glendale sold for $4.2 million, according to data from Jones Lang LaSalle Inc. The 13,654-square-foot property was built in 1981.

- A 4,459-square-foot office building at 1107-1109 N. San Fernando Blvd. in Burbank sold for $2.9 million. The Class C property was built in 1973.