For decades, the hope of local bioscience industry leaders and elected officials has been that Los Angeles County would develop into a major bioscience cluster capable of attracting the billions of dollars in venture capital that the rival Bay Area and San Diego claim.

It’s now happening, but not quite as expected or hoped. Instead of developing into one megacluster that carries significant clout, the region has seen the emergence of four to six widely scattered “microclusters,” each spurred by one or more institutions that serve as a localized driving force.

The four established microclusters include:

• The 101 Biotech Corridor that has sprouted around Thousand

Oaks-based Amgen Inc.;

• The Santa Clarita Valley, which was the preferred location for the late serial biomedical entrepreneur Alfred Mann to place his companies and eventually a foundation that’s now called HuMannity;

• Westwood/Santa Monica on the Westside, with UCLA as its driving force; and

• The San Gabriel Valley, between Caltech in Pasadena and City of Hope in Duarte.

Two more microclusters are trying to emerge: one around Cal State Los Angeles and its new bioscience incubator just east of downtown Los Angeles, and the other in the South Bay around the Lundquist Institute/Harbor UCLA Medical Center. But so far, these two areas lack the critical mass of significant companies to qualify as clusters.

“Industry clusters, especially in bioscience, tend to develop organically,” said Walid Sabbagh, the new chief executive of the Westwood-based Southern California Biomedical Council, which both tracks and acts as a resource for the region’s bioscience industry. Sabbagh took over last year after the death of longtime chief executive Ahmed Enany.

Overall, according to a report published last year by the biomedical council and Teconomy Partners, the bioscience industry accounted for nearly 50,000 jobs in Los Angeles County in 2022, while the six-county region making up Southern California (excluding San Diego) had nearly 123,000 jobs at more than 5,400 business establishments. The average wage of bioscience jobs in the six-county region in 2022 was about $114,000, 60% above the overall private sector.

The same report also looked at venture capital funding for both Los Angeles County and the six-county region (again excluding San Diego). From the start of 2019 through the third quarter of last year, the county drew about $5.4 billion in venture capital funds, about 55% of the regionwide total of $9.8 billion. Nationwide during that period, the sector attracted more than $250 billion in venture capital investment.

Sabbagh said four ingredients are generally needed to create a cluster: a driving institution such as a research university or institute; a mechanism for researchers to exit those institutions and start their own companies; the ability to pull in seed money or venture capital; and facilities for startups to use, including wet labs and animal-testing centers.

Once a cluster gets going, there needs to be a continual supply of talent and research funds – generally supplied by the driving-force institution – and venture capital to enable the companies to bring their therapies or medical technologies to market.

Often, it takes two or three bioscience company success stories in one of these geographic areas for venture capital firms to sit up and take notice, according to Brent Reinke, partner in the corporate securities group at Newport Beach-based law firm Stradling Yocca Carlson & Rauth. Reinke, who was instrumental in the creation of the 101 Bioscience Corridor, said that in the case of that cluster it was the success of a company called Kythera Biopharmaceuticals that prompted venture capital interest in other nearby companies. (Dublin, Ireland-based based Allergan bought Kythera in 2015 for $2.1 billion, providing a lucrative exit for venture capital and other investment firms.)

Likewise, the 2017 sale of Santa Monica-based Kite Pharma to Foster City-based Gilead Sciences Inc. for nearly $12 billion drew subsequent attention to the Westwood/Santa Monica area by venture capital firms.

This complicated interplay of foundational factors is a major reason why the region has so far been resistant to attempts from above to force the creation of one megacluster that would encompass all of these microclusters. In the early 2000s, industry leaders and local elected officials – particularly at the county level – attempted to create a single countywide cluster, but the effort eventually fizzled.

“Trying to impose the creation of a major cluster through a master plan just hasn’t proven very effective,” Sabbagh said.

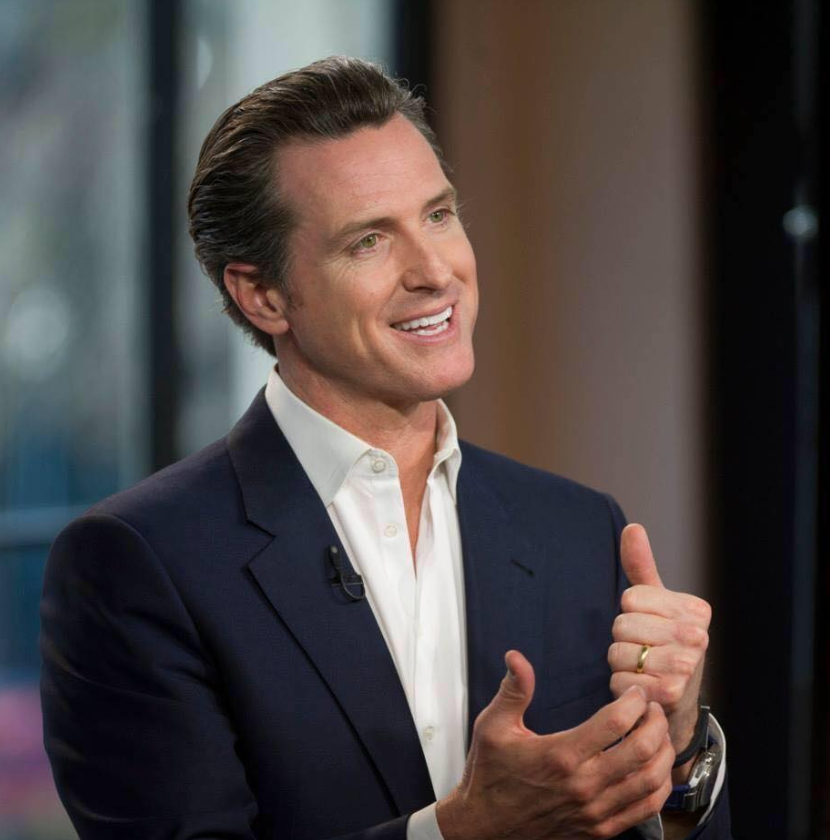

But one recent development could change this – or at the very least make the Westwood/Santa Monica cluster the dominant one. Last month, Gov. Gavin Newsom announced $200 million in state funding to help establish the California Center for Immunology at the now defunct Westside Pavilion shopping mall in Westwood; the center will be run by UCLA, which purchased the mall for $700 million. The physical research center is projected to be completed in mid-2027, with recruitment of researchers and staff expected to take another couple of years beyond that.

“If this immunology center takes hold, within a decade you could see that area turn into a really major bioscience cluster of national significance,” said Dan Gober, the new executive director of the Los Angeles chapter of San Diego-based trade group Biocom.