The San Fernando Valley residential real estate market saw an influx of buyers during the pandemic.

The area’s larger homes and lot sizes, and generally lower price points compared with other areas of L.A., lured shoppers to the area.

“During the pandemic, people’s priorities changed,” said Emil Hartoonian, a managing partner and principal of The Agency’s Calabasas, Sherman Oaks and Studio City offices. “That, coupled with financial markets that rewarded buyers with generous interest rates, led to an incredible frenzy, making buyers out of those who would not have been in the past and allowing people to qualify for more home than ever before.”

But now there are a few factors, including scarce inventory, higher interest rates and Measure ULA, threatening the once-booming market.

ULA’s impact

Measure ULA, which was passed by voters in November, took effect on April 1, requiring sellers to pay a 4% transfer tax on most residential and commercial properties priced or valued between $5 million and $9,999,999.99 and a 5.5% tax on assets of $10 million or more.

Proceeds from the transfer tax go toward increasing the affordable housing stock and efforts to prevent and end homelessness.

Litigation seeking to overturn the tax is pending in LA Superior Court.

While many are optimistic the court will side with the real estate industry, realtors noted an abnormal volume of sales activity prior to March 31, with many sellers slashing prices and offering bonuses to those willing to beat the clock.

Craig Knizek, a managing partner for The Agency’s Valley offices said that in the short time the transfer tax has been in effect the marketplace has demonstrated a remarkable reaction, with sales in the $5 million-plus price range down dramatically.

“What we’re noticing is that it is being baked into the negotiating process,” said Knizek.

In addition, he said more properties are being listed at just under $5 million and some aggressive buyers are negotiating lower prices from sellers by promising to cover the tax.

“It’s definitely more of an issue for properties under $10 million,” said Knizek. “We don’t have that many properties in the upper bracket, and once you are talking about those numbers there’s less concern among sellers. Still, it is causing some turmoil in the luxury real estate market.”

Tomer Fridman, founder of the Fridman Group at Compass, noted that the new tax applies only to communities within the jurisdiction of the city of Los Angeles, with higher-priced areas like Calabasas and Hidden Hills exempt.

Burbank and Glendale are also among the cities not subject to the tax.

“The Greater San Fernando Valley has fewer homes above $5 million-plus than the city of Los Angeles, so it is significantly less affected on a residential basis,” said Fridman.

Scarce inventory

The rush to leave big city life in search of space during the pandemic, together with favorable interest rates, left the Valley with a low vacancy rate.

Buyers lucky enough to secure properties during the pandemic aren’t in a hurry to move, either.

“Unless people undergo life-changing circumstances like a new job or a divorce, they aren’t looking to move, because if they do it’s going to cost a lot more,” Hartoonian.

Those in the market to rent a single-family home are looking at a larger inventory, but the prices are quite high.

“In Encino, home rentals are going for $5,000 to $25,000 per month,” said Hartoonian.

One reason for the rise in prices, said Compass agent Erica Fields, is the Woolsey Fire, which increased demand for short-term rentals; residents were willing to pay more because they were in emergency situations.

“Now most people have moved back to their homes and the owners have become accustomed to the high rental prices,” said Fields, who is based in the San Fernando Valley. “It’s a huge shift for owners, and many of these rentals are now becoming stagnant on the market.”

Though there is less inventory, homes that do become available are sitting on the market longer, as buyers are now more selective and willing to shop for the best deal.

Rising interest rates

One of the primary reasons agents said many are hesitating, especially in the lower price ranges, is the high interest rate.

“First-time homebuyers and those looking at sub-$3 million properties are most affected by the interest rates,” said Michelle Schwartz, a managing partner for The Agency’s Valley offices. “Buyers in the $5 million-plus category realize that you marry the house and date the interest rate. We are seeing multiple offers on the sub-$3 million properties, but that’s not necessarily the case on the higher end.”

In the ever-fluctuating market, cash is key, said Marty Azoulay, president of Equity Union Real Estate’s My House Sellers.

“People with cash have more room to maneuver and negotiate,” he said. “In fact, about 10% to 15% of all transactions happen in cash.”

Azoulay has also seen an explosion of sales in Woodland Hills, Tarzana and West Hills due to the large number of underpriced properties.

“Mulholland Park has also come into its own, with prices up almost 30% over the last four years as more younger people are moving in and helping to rejuvenate the area,” said Azoulay.

Although the market has changed and buyers are now facing new obstacles, realtors said the Valley still has much to offer.

Looking for value

Knizek and Schwartz said there are reasons some buyers have historically been interested in the Valley, including more spacious living conditions and appealing price points.

“There used to be a substantial price differential between homes on the Westside and the Valley, with buyers being able to purchase a lot more house for their money, but the gap has been closing,” said Knizek. “Further out in the Valley toward Tarzana is where attractive value remains.”

“There will always be pockets within Los Angeles and the Greater San Fernando Valley that provide immense value for a buyer,” Schwartz added.

“For example, first-time homebuyers will continue to trend towards the Valley because there is always greater opportunity for a value buy.”

Others are flocking to the Valley in search of a more family-oriented lifestyle, in neighborhoods known for better schools, easier parking, lower crime rates and less homelessness.

“There’s a much greater interest in gated communities since Covid because security and safety are big concerns,” said Schwartz. “The prices in those communities have nearly doubled from pre-Covid times.

“The Los Angeles Unified School District lost a lot of students to private schools that are located here in the Valley, so parents are no longer worried about living within the district,” Schwartz added.

Larger numbers of celebrities, musicians, and influencers now call the Valley home, especially in Hidden Hills, making the area a trendier option for those who might previously have shied away, said Schwartz.

“Ultimately, high net-worth folks are seeking land, space and security,” she said.

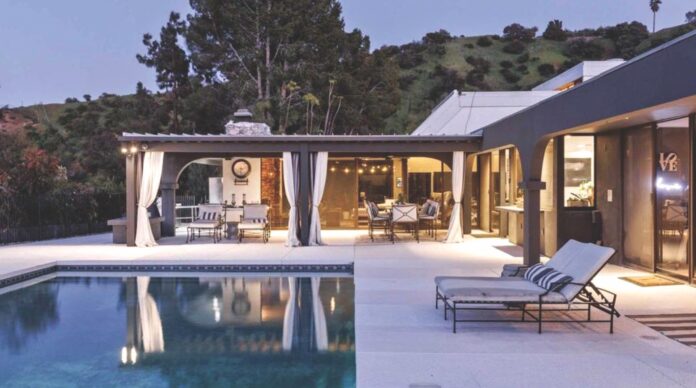

Ideally, buyers are looking for large plots of land in turnkey-ready properties that are aesthetically pleasing, said Schwartz. But when those aren’t available, they are open to buying and upgrading.

Fields said she’s noticed a preference for one-story homes, with a lot of land and a pool in a good school district.

“The hottest commodities are for homes under $1 million in a desirable area,” said Fields. “For most of those properties, I get 15 to 35 offers.”

What’s next?

Compass’ Fields said she expects the ULA tax will deter some sellers from putting properties on the market, at least in the immediate future.

“While this change will affect everyone in this price range, some may have less of a challenge getting over this obstacle,” said Fields.

With constrained inventory expected to remain a constant and prices continuing to be a concern, buyers will likely keep their options open.

“It used to be people would not go past Encino; now they’re looking at communities that may be slightly farther but provide much more bang for your buck,” said Azoulay.