While contraction in the cannabis industry in California continues, one segment is seeing growth – testing labs.

Evelyn Alvarez, quality control director at Pasadena-based Encore Labs, called Southern California one of the most competitive markets for labs.

“It is great to see how far some of these labs have come, including ours, in terms of growth,” Alvarez said. “We are just kind of keeping with our strategy of organic growth and keeping our quality as one of our number-one priorities.

“We do hope for more action from the (California) Department of Cannabis Control on the regulatory end of things and helping keep the market more level,” she said.

Joe Wang, a co-owner of Encore, said the company is testing an increasing number of products from more brands and manufacturers.

“But at the same time, there are many cannabis businesses that are laying off staff and going under due to the market conditions, so we are losing testing business there,” Wang said. “So it is a bit tough to say right now (if the testing segment is growing), as the market is still recovering. We are still doing fine as a lab and business.”

The labs test for potency of THC and other cannabinoids, as well as for residual solvents left over from the manufacturing process, plus heavy metals – arsenic, lead, mercury and cadmium – that can be found in the plant.

THC, or Tetrahydrocannabinol, is one of 113 cannabinoids identified in cannabis and is used to treat people suffering from multiple sclerosis and other disorders.

The labs conduct the testing for growers, manufacturers and distributors of cannabis products.

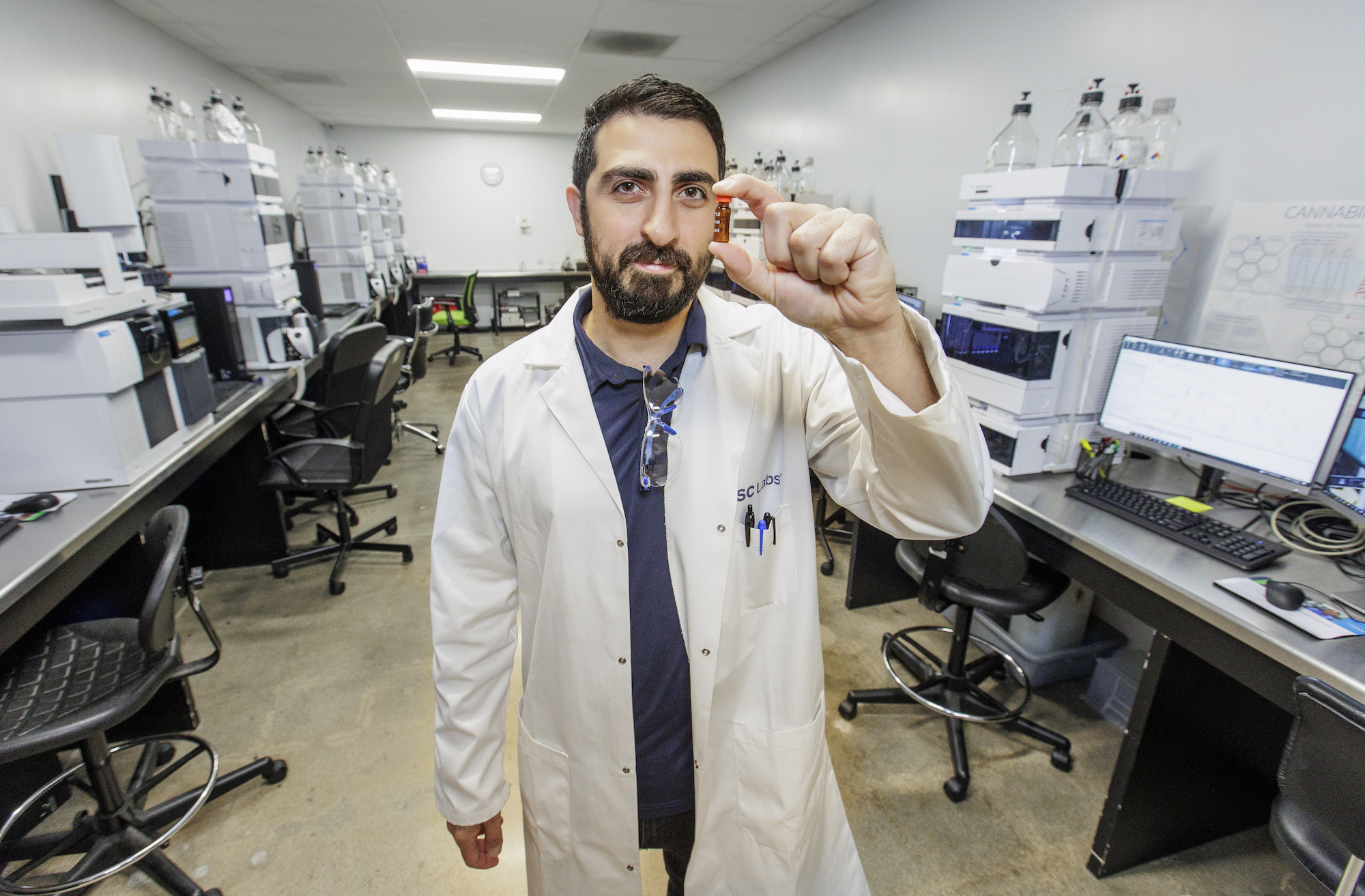

Josh Wurzer, chief compliance officer and co-founder of Santa Cruz-based SC Labs, said the cannabis industry in California is still trying to find its groove.

“We had a lot of growth after adult use came into effect (in 2018),” Wurzer said. “Everybody wanted to start a cannabis business.”

He said it seemed as if a lot of people felt the high wholesale prices for cannabis would stick around forever, he continued.

It seems like the industry follows a pattern of where it is growth, growth, growth for about five years and then the overproduction catches up with everyone and then the wholesale prices fall through the floor at the five-year mark. That is followed by a period of one to two years in which the market has to find its way back, and then it begins to stabilize, Wurzer said.

“I am thinking about Colorado,” he added. “Oregon is still kind of a mess, but Washington State has followed that pattern.”

He is optimistic that the demand for cannabis isn’t going away.

“But it has not been an easy business to make a buck in over the past several years,” he added. “The last several years it seems to be a lot of doom and gloom. It seems like we are coming back from that.

“The fundamentally sound businesses are the ones that are remaining,” Wurzer continued. “Hopefully we will come to a more stable, more predictable market as we find our way.”

SC Labs opened a testing facility in Van Nuys earlier this year.

Opening a cannabis lab takes from $4 million to $5 million at the low end, including equipment and everything you need to get going, Wurzer said.

Growing market

Global Market Insights, a market research company based in Selbyville, Delaware, stated in a report published in March that the global cannabis testing market was valued at just more than $7 billion last year and is expected to increase around 13.5% annually through 2032, when its market value is forecast to hit $27.5 billion.

In the U.S., the testing market’s value was $1.5 billion in 2021, according to a GMI report from last year. The market is expected to grow 10.5% annually and reach $4 billion in the U.S. in 2030.

The GMI report added that the Pacific Central zone, which includes California, is expected to grow 10.5% a year through 2030.

“Due to substantial demand for medical marijuana in such states as California and Oregon, along with favorable regulatory norms pertaining to cannabis testing in the states, the zone is speculated to maintain its dominance in forthcoming years,” the report stated.

SC Labs was among the companies listed in the report as being major providers of testing services in the U.S. Others include Oakland-based CW Analytical Laboratories, Digipath Inc., PSI Labs, in Ann Arbor, Michigan, Santa Rosa-based Pure Analytics LLC, and Steep Hills Inc.

“These companies are majorly engaging in organic collaborations and partnerships with private and public firms to expand their customer reach, thereby influencing the overall business scenario,” the GMI report added.

Las Vegas-based Digipath sold its lab subsidiary in May and is exiting the market.

Steep Hills, based in Toronto, also exited the cannabis testing market and has no operations in the U.S.

Due diligence

Testing labs determine the potency of cannabis and of other chemicals and materials found in the market’s products. Every cannabis-related product is tested, typically before it gets put on a shelf at a dispensary or store.

Richard Butunts, the manager of SC Labs’ Van Nuys lab, said that many products have come through the facility since it opened in January, including brownies and cookies.

“We’ve even had beef jerky come through the lab,” Butunts said.

“If we can’t test it then we’ll figure it out,” he added. “We have a great R&D team here at SC Labs that works on that.”

The Van Nuys location marks a return to Southern California for the company. It had operated an Orange County lab for a few years until it decided to close it down, said Wurzer, the chief compliance officer.

“It was too difficult to do, and it made more sense to consolidate the testing into the home lab in Santa Cruz,” he added.

The Orange County lab closed in 2016 after it was determined that the testing turnaround times made it difficult to compete with other Southern California labs, Wurzer said.

Opening in the San Fernando Valley was an “opportunistic” move, he continued.

“We had been looking at SoCal for a while, but with the market contracting in California we probably weren’t actively in pursuit of a physical expansion into SoCal this soon,” he said. “But the opportunity was there, it’s a beautiful lab and the price was right.”

The building, at 7027 Hayvenhurst Ave., formerly housed a cannabis testing lab operated by CannaSafe Labs; it was closed by the company last summer. The site came with all of the lab’s equipment, Butunts said.

According to a story published in July of last year in Analytical Cannabis, the lab was the victim of lab shopping.

“The issue of lab shopping and ownership decision not to play in that arena ultimately led to the closure,” said Iniobong Afia, then the chief science officer at CannaSafe.

Lab shopping is the practice of cannabis-product companies using different labs until they get the results they are seeking.

“When people are able to test compliance samples at multiple labs and pick the most favorable result for sale, then it makes it very difficult for labs with integrity to get on the playing field,” Afia was quoted as saying in the article.

The practice has led to proposed legislation designed to reduce or eliminate it.

AB1610, introduced by Assemblymember Reggie Jones-Sawyer (D-Los Angeles) in March, was passed by the Assembly in May and is now before the state Senate.

A hearing on the bill is scheduled in July for the Senate’s Business, Professions and Economic Development committee.

The bill requires audits, shelf product testing and blind proficiency lab testing. It also mandates that any product recall to be publicly reported to consumers online, in addition to requiring that all licensed labs be annually audited by the Department of Cannabis Control, according to Jones-Sawyer’s office.

SC Labs is a sponsor of the bill.

“Every consumer market is based on trust that a product’s label accurately describes its contents,” the company said in a statement in support of AB1610. “Right now, bad actors in California’s legal cannabis industry are breaking that trust by artificially inflating THC on product labels through fraudulent testing results.”

The statement cited a study conducted last year of more than 150 random products that found 87% illegally overstated THC content and that a number of products also contained harmful levels of pesticides.

“This fraud is motivated by profit, and current market incentives make cheating a financially sound strategy,” the SC Labs statement said.

“Consumers have shown they are willing to pay more for higher THC content in products, so higher THC labels means more revenue,” the statement continued.

As a result, bad-actor labs intentionally inflate THC levels through unscientific methods or outright fraud, which puts consumers at risk (for health impacts), the statement said.

“This dynamic creates a race to the bottom as market participants feel the need to keep up with ever-increasing potency numbers while labs who refuse to inflate results lose market share,” the company said. “Without greater enforcement and transparency in the market, this dynamic will continue to weaken confidence in the legalized market and harm industry groups that operate with integrity.”

In 2021, the Legislature passed, and the governor signed, SB 544, which required the Department of Cannabis Control to establish standardized cannabinoid test methods to be used by all testing laboratories by Jan 1. The department is in the process of finalizing those regulations, according to an analysis by the Assembly on AB1610.

The new bill (1610) would go further by requiring DCC, by Jan. 1, 2025, to establish a standard laboratory blind proficiency test method for use by all testing laboratories; to establish quality assurance standards and testing procedures for products available for retail sale; and requires the DCC to audit testing laboratories annually and post the results, including any record of a violation, on its website for an unspecified number of years, the Assembly’s analysis said.

Abundant automation

All the testing equipment at SC Labs in Van Nuys is automated, said Butunts, the facility’s manager.

“We tell it all the samples it will run. We let it run. It’ll do its thing and goes through the whole process until it gets to the last sample, then it’ll shut down,” he said.

The lab tests for potency of cannabinoids and THC, as well as for residual solvents left over from the manufacturing process, plus heavy metals – arsenic, lead, mercury and cadmium.

Encore tests for all the same materials, said Alvarez, the company’s quality-control director.

“On the safety side of things, there is a large amount of contaminants that the state requires us to test for,” she said. “Now that we have a regulated market we want to ensure that the products on that market are safe and accurate.”

The non-safety side of testing is for cannabinoid potency and THC, as well as for terpenes – naturally occurring elements in a plant that give it a distinctive scent, she added.

“That is another test that we perform for profiling and consumer preference of choosing what kind of strains they want, not so much on the safety end of things,” Alvarez said.

The cost of testing can range from as low as $375 to $500 for a full compliance panel, or battery of tests, said SC Lab’s Wurzer. It is a relatively reasonable amount to pay, he said.

For a batch of cannabis flower or the dried plant material that can weigh 50 pounds maximum and can cost $1,000 a pound that equates to $50,000 in value, Wurzer said.

Even at the high end of $500, the cost is 1% of the value in compliance and safety testing, he said, adding, “That is a drop in the bucket for the amount of consumer safety we are getting out of it.”