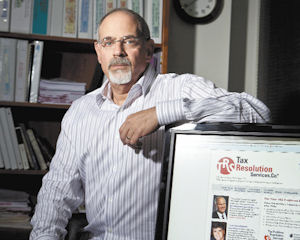

Eliminate debt. Get a fresh start on your financial future. Get the IRS off your back. You’ve heard the late-night TV commercials, and they haven’t necessarily been good for the multi-million dollar tax resolution industry, which has been the target of state and federal investigators. Michael Rozbruch, founder and CEO of Tax Resolution Services in Encino, wants to send a new message as he prepares to launch his first series of television commercials in January. “We will tout the customer service,” Rozbruch said. “We will talk about our reputation and our high standing with the Better Business Bureau.” Tough financial times have forced many taxpayers into the collection division of the IRS. As a result, Rozbruch, a CPA who helps negotiate their tax debt, has more business than he ever imagined. At the same time, attorneys general across the country are chasing many of his competitors for deceptive business practices, giving his entire industry a huge black eye. Those late-night ads promising taxpayers that they could settle with the IRS for pennies on the dollar, the AGs assert, are largely lies. Rozbruch says, in his business, there’s no such thing as too much publicity, though some of his competitors took the wrong approach and it backfired. Will his softer approach work? Historically, companies that help consumers get out of their IRS debt have relied on dramatic late-night TV and radio commercials that feature frightened taxpayers in trouble with the IRS. While these ads are now being used as evidence in numerous lawsuits and investigations against the more disreputable companies in the business, it’s hard to argue with their effectiveness. Rozbruch himself produced many of them over the years. His radio commercials on the Howard Stern show, which put him on the map, prodded guys to “man up,” to their IRS debt. “Be a man,” was an oft-heard refrain on Los Angeles stations like KLOS. The aggressive push, together with advertising on Rush Limbaugh, Glenn Beck and Sean Hannity, has helped TRS grow 84 percent over three years to $17 million, making it the 18th fastest-growing company in the Valley. TRS is on track to ring up $23 million in sales this year, according to Rozbruch. ‘Rush told me to call’ The image makeover may be necessary. But it may not come naturally for this self-described hard-driving, “unconventional CPA,” whose passion is drag racing his ’68 Oldsmobile Cutlas 442. Rozbruch realized early on that he didn’t fit well into the corporate world. After working for a series of companies, including Charles David of California, as chief financial officer, he decided to go into business for himself in 1998. “If you want to work in a company, you need to be either a phony or a politician,” he said, “and I’m neither. I just tell people what I feel.” He started to look around for what he could do with his accounting experience and education. What he found was a two-by-two ad in the Journal of Accountancy. The ad urged accountants to call if they wanted to add up to $25,000 a month to their accounting practice. Rozbruch sent away for what was then a $697 guide to the tax resolution business. “There were 42 ideas on how to market to individuals who were in trouble with the IRS,” said Rozbruch. “I did every one of them. A lot of my friends, other lawyers and CPAs, thought I was crazy. They looked down on it; they thought it was low-class.” Within four days, however, he received 88 calls and he knew he had a business. But the real moment of discovery came seven months later when a salesman from KLSX convinced him to buy some rotator spots on the station, advertising that would cost just $25 a spot and would run randomly at various hours of the day or night. Every once in a while, his ad got on the Howard Stern show, and Rozbruch noticed that his phones started to ring off the hook. “That’s when I discovered that in advertising this business it’s all about where you run the spot and who the personality is.” The people who were up late at night listening to Stern were his demographic. By 2007, Rozbruch had his “demo” so well figured out that he was buying spots on Rush Limbaugh, Glenn Beck and Sean Hannity. Though he’s conservative politically, it wasn’t about the ideology, he said. “I wish I could find an equivalently good market that caters to liberals,” he said. “But it doesn’t exist. These guys reach 30 million listeners in 800 major markets!” The radio personalities have so much pull, Rozbruch said, that callers will literally tell TRS reps that ‘Rush told me to call.’ Each client account at TRS is labeled as a referral from “Rush,” “Glenn” or “Sean.” The radio hosts have helped TRS acquire more than 3,000 clients in all. Each pays between $5,000 and $25,000, depending on the complexity of their case. Industry needs ‘quality control’ While TRS has no intention of pulling its advertising from these shows, Rozbruch said that in the wake of the investigations into the industry, the tax resolution business needs a different image, one that conveys trust and integrity. Among the firms that have come under scrutiny are Beverly Hills-based American Tax Relief LLC, which was shut down by a federal judge last year on the recommendation of the Federal Trade Commission. The FTC said the company bilked consumers of more than $60 million by falsely claiming it could reduce their IRS debts. Last August, then California Attorney General and current governor Jerry Brown sued Sacramento-based self-described “Tax Lady” Roni Deutch, alleging she preyed on consumers who could not afford their tax bills. Brown sued to permanently shut her down. Deutch finally surrendered her business licensed in May. Headquarters: Encino CEO: Michael Rozbruch 3-year growth rate: 84 percent 2010 Revenue: $17 million 2009 Revenue: $12.4 million 2008 Revenue: $9.2 million Texas-based Tax Masters and South Carolina- based JK Harris & Co. have also come under scrutiny. Attorneys general in multiple states are investigating the companies. JK Harris filed for bankruptcy protection in October. Rozbruch said the scrutiny is good for the industry, as is the house-cleaning. He said these companies hired hundreds of salespeople with little knowledge or understanding of tax law and never delivered on what they promised. “They take people who never qualify for any IRS program, take their money and do nothing in return.” How is he different? “We screen the calls very carefully. We turn away half the people who call us.” That’s because most people who owe the IRS money don’t qualify for a reduction. It’s the rare person — for example, a so-called “innocent spouse” — who can expect the kind of settlement many IRS debt relief agencies advertise. To help his sales representatives separate the people who could benefit from his services from those who really can’t, Rozbruch said he puts each of them through a four to five week training program. By contrast, he said, his competition does little sales training. And while he claims that his competition hires 10 sales representatives for every case worker, he said he has more than six case workers for every sales representative. “They are interested in getting the client in the door, not doing the work. My emphasis is on quality and quality control. I want every case done as if I was still doing it.”