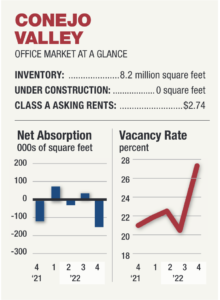

Conejo Valley

The Conejo Valley office market had a difficult fourth quarter. Tenants gave back nearly 158,000 square feet and vacancy rates soared to 27.6%, up from 20.4% the previous quarter. No new office product was under construction. Asking rents fell 1 cent quarter over quarter, but rose 3 cents year over year to $2.74 a square foot. In the industrial market, vacancy increased to 4.1%, up from 0.5% the previous year.

Main Events:

Village Green Office Park, an office property at 5655 Lindero Canyon Rd. in Westlake Village, was bought by Garden Communities California from Nasch Properties for $40 million.

A 104,267-square-foot industrial property at 3500 Willow Lane in Thousand Oaks sold for $40 million. Willow Hurst sold the property to HR Laboratories. Lee & Associates represented the seller. Mazirow Commercial Inc. represented the buyer in the transaction.

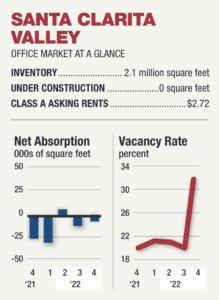

Santa Clarita Valley

Office vacancy during the fourth quarter soared to 32.3%, up from 19.7% the previous quarter and 19.3% the previous year. Asking rents held steady quarter over quarter but increased 5 cents year over year to $2.72 a square foot. No new office product was under construction.

Main Events:

The Williams Ranch community celebrated its grand opening in the Santa Clarita Valley. Created by Santa Clarita-based builder Williams Homes, the master-planned community, located at 28801 Hasley Canyon Rd. in Castaic, features 497 single-family homes across 430 acres.

A 24,270-square-foot retail property at 24075 Magic Mountain Parkway in Valencia sold for $20 million. Greenlaw Partners purchased it from Pradeep Bakshi.

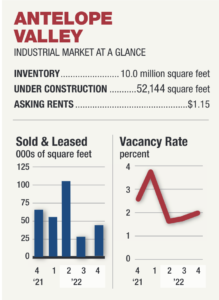

Antelope Valley

A total of 46,857 square feet of industrial space was sold or leased in the High Desert during the fourth quarter. The vacancy rate was 2%, up from 1.9% the previous quarter but down from 2.6% the previous year. Asking rents increased 30 cents year over year to $1.15 a square foot.

Main Events:

Three undeveloped land sites totaling 23 acres in Palmdale sold for a combined $7.3 million. The trio of properties are part of the Palmdale Trade and Commerce Center. P&L Realty LLC acquired the sites from SYCG-MGP Palmdale I LLC.

Bridge Group Investments and Burbank-based Steerpoint Capital acquired the Antelope Valley Mall in Palmdale for $60 million. The firms plan to find a new tenant for the mall’s vacant Mervyn’s big-box store and to enhance the property by adding amenities and a new food court.

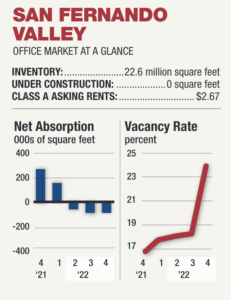

San Fernando Valley

Office tenants gave back nearly 48,000 square feet during the fourth quarter. The vacancy rate rose to 23.6%, up from 17.6% the previous quarter and16.4% the previous year. Asking rents fell 1 cent quarter over quarter and 5 cents year over year to $2.67 a square foot. In the industrial market, the vacancy rate was a mere 0.6%.

The vacancy rate rose to 23.6%, up from 17.6% the previous quarter and16.4% the previous year. Asking rents fell 1 cent quarter over quarter and 5 cents year over year to $2.67 a square foot. In the industrial market, the vacancy rate was a mere 0.6%.

Main Events:

Los Angeles Rams owner Stan Kroenke expanded his Warner Center portfolio with the $325 million purchase of The Village shopping center in Canoga Park. According to the seller, Unibail-Rodamco-Westfield, it represented the nation’s second biggest shopping center transaction this year. The company sold its Santa Anita mall to Wen Shan Chang for $538 million in August. Kroenke has purchased a handful of other assets in the nearby area as well, leading to speculation of planned developments in the area.

Calabasas-based Agora Realty & Management acquired a 75,000-square-foot medical office building in Tarzana for $30 million in an off-market deal. The three-story Tarzana Medical Plaza, located at 5525 Etiwanda Ave., is 90% occupied. Tenants that include Providence Healthcare Systems, Cedars-Sinai Medical Care and Unilab Corp.

Jagdish & Usha K. Varma purchased a 60-unit apartment building at 4805 N. Bakman St. in North Hollywood from Hillock Land Company for $29.3 million.

Ganahl Lumber Co. purchased an industrial building at 18537 Parthenia St. in Northridge from Northridge Lumber Inc. for $9.05 million.

A 2,500-square-foot convenience store and full-size service station at 9108 De Soto Ave. was net leased to 7-Eleven in Chatsworth sold for $4.6 million. NAI Capital Commercial Investment Services Group Senior Vice President Mehran Foroughi represented the buyer, a California-based private investor, in the transaction. Alex Kozakov and Patrick Wade of CBRE Group Inc. represented the seller, Desoto Holding.

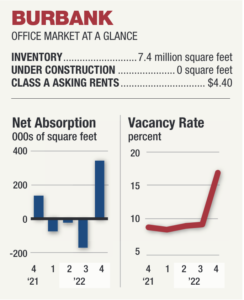

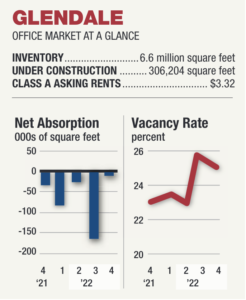

Burbank and Glendale

More space is available in Burbank’s and Glendale’s office markets as tenants gave back nearly 348,000 square feet in Burbank and 6,000 square feet in

Glendale. The vacancy rate in Glendale rose to 25.2%, while the rate inBurbank rose to 16.5%. In Burbank, the asking rent was $4.40 a square foot, up 37 cents in a year. In Glendale, the asking rent was $3.32 a square foot, up 13 cents in a year.

Glendale. The vacancy rate in Glendale rose to 25.2%, while the rate inBurbank rose to 16.5%. In Burbank, the asking rent was $4.40 a square foot, up 37 cents in a year. In Glendale, the asking rent was $3.32 a square foot, up 13 cents in a year.

Main Events:

BLT Enterprises acquired seven industrial and creative office properties for $130 million. Among the assets: A 10,246-square-foot warehouse building at 2901 Thornton Ave. in Burbank.

The Brooklyn Cos. bought an office property at 40 E. Verdugo Ave. in Burbank from Lion Real Estate Group for $14.2 million.

A 27,080-square-foot retail property built in 1946 at 132 N. Maryland Ave. in Glendale sold to Aengus Oneil Dunne for $8 million.

A 45-unit apartment complex at 1550 Verdugo Rd. in Glendale was sold to Faruque & Maria S. Sikder by Walker Family Trust Survivors Trust A for $16.2 million.