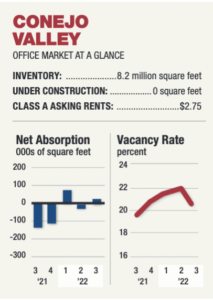

Conejo Valley

Office tenants took more than 14,000 square feet during the quarter, while no office product was under construction. The market experienced a vacancy rate of 20.4%, down from 22% the previous quarter. In the industrial market, the vacancy rate increased to 3.4%, up from 1.6% the previous year. Rents still rose 30 cents in a year.

- The Lexington Apartments, a 178-unit rental community in Agoura Hills, sold for $87.3 million. Intercontinental Real Estate Corp. — in a joint venture with MG Properties — acquired the property. Built in 1986, the Lexington offers a unit mix of one- and two-bedroom apartment homes housed in 11 two-story residential buildings on a 15-acre site at 30856 Agoura Road.

- Yolo East, a 45-unit multifamily property located in Thousand Oaks, sold for $22.6 million, or $502,222 per unit. The property, located at 1801 Los Feliz Drive, sold for $511 per square foot.

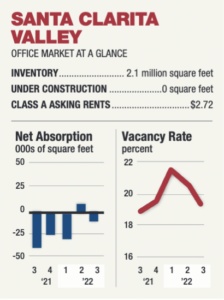

Santa Clarita Valley

Office vacancy during the third quarter was 19.7%, down from 20.4% the previous quarter but up from 18.8% the previous year. Asking rents increased 2 cents quarter over quarter and 7 cents year over year to $2.72 a square foot. In the industrial market, the vacancy rate was a mere 0.3%. The asking rent was $1.37 a square foot, up 47 cents year over year but steady quarter over quarter.

- Pelican BioThermal, a manufacturer of temperature-controlled, thermally-protected packaging, signed a five-year, 54,060 square-foot industrial lease at 28308 Industry Drive in Valencia. It is a free-standing warehouse and distribution space with two ground-level doors, six dock-high positions and 28-foot clearance height ceilings.

- Lyons Properties sold an office building at 23206 Lyons Ave. in Santa Clarita for $11.3 million.

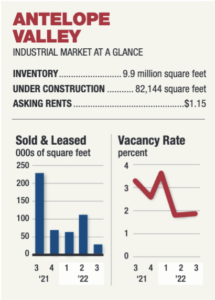

Antelope Valley

A total of 29,732 square feet of industrial space was sold or leased in the High Desert during the quarter. The vacancy rate rose was 1.9%, down from 3.1% the previous year. Asking rents were $1.15 a square foot, up 15 cents from the previous quarter and 32 cents over the previous year.

- Valley Central, a 375,541-square-foot community shopping center in Lancaster, sold for $45.3 million. The mall, at 44400 Valley Central Way, spans over 35 acres and includes 17 different entry drives. The property is part of a larger 715,000-square-foot Super Walmart-anchored shopping center.

- SRS Real Estate Partners completed the sale of three retail properties that are part of a larger complex called Palmdale Marketplace for $10.2 million. Located at 39340 10th Street W., Palmdale Marketplace is a 214,000-square-foot power center anchored by Target, Lowe’s Home Improvement and Sprouts. The biggest asset to sell was a 5,958-square-foot property.

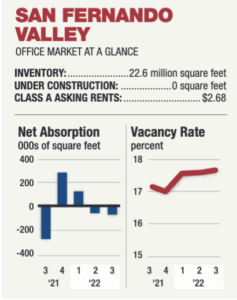

San Fernando Valley

Office tenants gave back more than 47,000 square feet during the third quarter. The vacancy rate rose to 17.6%, up from 17.4% the previous quarter. Asking rents fell 1 cent quarter over quarter to $2.68 a square foot. In the industrial market, the vacancy rate was a mere 0.5%. Asking rents increased 10 cents quarter over quarter to $1.64 a square foot.

- Three multifamily properties in the San Fernando Valley sold for a combined $70.5 million. The 154-unit Brooks Venture Apartments — located at 17200 Burbank Blvd. in Encino — sold for $51.3 million, or $332,792 per unit. The 36-unit Fruitland Villa Apartments — located at 10831 Fruitland Drive in Studio City — sold for $12.1 million, or $336,111 per unit. The 26-unit Weddington Oaks Apartments — located at 5259 Sepulveda Blvd. in Sherman Oaks — sold for $7.1 million, or $273,076 per unit.

- Tarzana-based Gelt Inc. acquired Avalon Studio 4121 — a 149-unit value-add apartment property at 4041-4121 Radford Ave.in Studio City — for $76 million.

- Ventura Property Management bought the 154-unit Brookside Terrace Apartments at 17200 Burbank Blvd. in Encino for $51.3 million.

- AVG Partners purchased the 91,339-square-foot Corporate Center at 26707-26709 W. Agoura Rd. in Calabasas from Majestic Asset Management Inc. for $35 million.

- Harbor Associates — in a joint venture with Platform Ventures — acquired a 118,906-square-foot commercial office and research and development building in Agoura Hills for $19.3 million. Harbor signed A2 Biotherapeutics to a long-term, 75,994-square-foot lease at the building, which is located at 30601 Agoura Road. The building will serve as A2 Biotherapeutics’ new global headquarters.

Harbor Associates and Platform Ventures acquired a building in Agoura Hills. - Brickstar Capital bought the 66,721-square-foot Valley Country Market Shopping Center at 20929 Ventura Blvd. in Woodland Hills from Atlas Capital Group for $19.7 million.

- The Addison Arms Apartments, a 57-unit apartment building in Sherman Oaks, sold for $21 million, or $375,893 per unit. The previous owners of Addison Arms spent $2.2 million on capital expenditures to upgrade property systems, common area amenities, and 45% of the unit interiors.

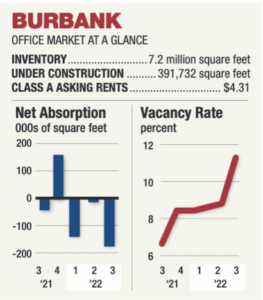

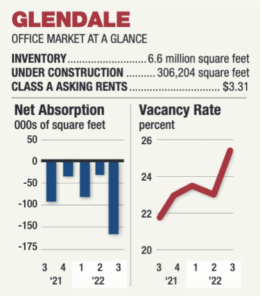

Burbank and Glendale

More space is available in Burbank’s office market as tenants gave back 178,814 square feet during the quarter and the vacancy rate was 11.7%. Office rents held steady quarter over quarter at $4.31 a square foot. In Glendale, the office vacancy rate rose to 25.4%. The asking rent was $3.31 a square foot. The Tri-Cities market had more than 1million square feet of office product under construction during the quarter.

- Worthe Real Estate Group is planning a five-story residential tower on a vacant, triangular-shaped parcel just north of the 134 Freeway in the Burbank Media District. The project, located at 3201 W. Olive Ave., would see the construction of a mixed-use building featuring 144 apartments above 1,058 square feet of ground-floor retail space and two levels of subterranean parking.

- SDI Media signed a lease for 52,217 square feet at the Link, 2901 W. Alameda Ave. in Burbank, with owner Pendulum Property Partners.

- Brookfield Property Group sold the 117,868-square-foot Glendale Corporate Center at 425 E. Colorado St. for $23 million to Premier Place.

- An industrial flex facility in Burbank sold in an off-market sale for $3.9 million. The approximately 10,000-square-foot warehouse located at 3401 W. Pacific Ave. had been renovated.

A $370 million redevelopment is planned for a former Sears store. - San Diego-based developer Merlone Geier Partners proposed a $370 million redevelopment of a defunct Sears store in Glendale. The firm wants to construct a 682-unit residential complex with 38,100 square feet of space for a public park at the 236 N. Central Ave. site.