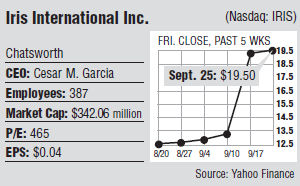

Danaher Corp. will acquire Iris International Inc., a Chatsworth manufacturer of automated urinalysis and blood testing equipment, in a deal worth $338 million. The deal is the second sale of a large San Fernando Valley medical equipment manufacturer in three months, and it follows the $925 million sale of One Lambda to Waltham, Mass.-based Thermo Fisher Scientific Inc. in July. Iris was not looking to sell. In fact, it rejected four previous offers from other large medical device makers Mass.-based Thermo Fisher Scientific Inc. in July. Iris was not looking to sell. In fact, it rejected four previous offers from other large medical device makers in the last eight months, company officials said. But the offer from Danaher was too good to pass up, as it was higher than the trading value of Iris’ shares at the time. Danaher, which makes a range of products from electronic measurement instruments to dental supplies, will pay $19.50 a share in cash for all shares of Iris. The deal is expected to close in the fourth quarter, when Iris will be folded into Danaher’s Beckman Coulter Diagnostics business. “They put up a number big enough that the board thought it was in the best interests of the shareholders,” said Chief Financial Officer Amin Khalifa. Baltimore-based investment firm Brown Capital Management is the largest institutional investor in Iris with more than 3.1 million shares, or a 17.3 percent stake in the company. Acquisitions have been critical to Danaher’s growth strategy. The Washington D.C. company boasts more than 400 acquisitions since 1984. Danaher has a pattern of buying well-run independent companies with technology that the company finds attractive, said Daniel Holland, an analyst who follows the company for Morningstar Inc. in Chicago. Holland said Danaher often will refine operations following an acquisition. The savings from cost cutting is typically reinvested in the company, Holland said. “Over time they evolve the business to where they want to see it go,” he said. Savings will probably come from eliminating expenses associated with being a public company, said Raymond Myers, a healthcare technology analyst with The Benchmark Co. Iris management does not expect to see the research and development or the commercial operations relocated from the Valley, Khalifa said. “We are confident we will remain in Chatsworth,” Khalifa said. Danaher likely will want to keep the employee base directly involved with the clinical work, Myers said. “It is what they are buying after all,” he said. The purchase represents the latest medical device company to be purchased in what analysts say appears to be a trend driven by access to cheap capital. Of the companies Myers follows, it is the second company to be acquired this year. The other was eResearchTechnology Inc. of Philadelphia bought by private equity firm Genstar Capital LLC in a deal valued at $400 million. Myers said low interest rates make “acquiring the business inexpensive for the (buyer).” New opportunity Danaher is a global manufacturer with five business segments. In the second quarter, the company reported net earnings of $600.1 million, or $0.84 per diluted share, on revenue of $4.5 billion. Danaher employs 59,000 people. Danaher officials could not be reached for comment. Iris has diagnostics and sample processing (centrifuges) divisions, and a subsidiary, Iris Personalized Medicine. In the second quarter, Iris reported net income of $1.2 million, or $0.07 per diluted share, on revenue of $30.9 million. The company has about 387 employees. Sales by the company have generally risen in recent years. The company’s small size disguises its importance to the specialized urinalysis market. Iris has 50 percent of the global market for the equipment. When its in-house designed blood testing equipment reaches the market, it will be groundbreaking because it will be able to give images of the blood cells, Khalifa said. It was this technology that in all likelihood attracted Danaher to Iris, Khalifa added. “The urinalysis and hematology (equipment) would be the right fit with Beckman Coulter,” Khalifa said. Iris has brought modern technology to medical testing and analysis. For decades urinalysis involved looking at samples on slides. Automated equipment such as that developed by Iris does the work in place of a technician, who can then turn his or her attention to other processes that are not automated. “When you go into labs today, they will call (the equipment) ‘My Iris,’” Khalifa said. “It is incredible how much customer loyalty there is to the product.” Iris for years has supplied to the higher end of the market. In July 2011, the company introduced the iRICELL 1500 urine testing system for labs doing less than 70 tests a day. Iris has put significant research dollars in the 3GEMS (or third-generation morphology system), the platform for the next generation of urinalysis and hematology equipment, Myers said.