Fewer local bioscience and digital health firms received funding over the last couple of years than in previous years, but for those that have gotten funding, the pots of money have grown larger.

That’s the conclusion of a report released last week by the Southern California Biomedical Council, a Westwood-based association that supports and promotes the local bioscience industry.

One trend found in the report was the emergence of the 101 Corridor as a major biomedical hot spot, stretching from Woodland Hills on the east to Camarillo in Ventura County on the west.

Companies within that corridor received $547 million last year, led by a $300 million fundraise from Agoura Hills-based biopharma company Acelyrin Inc.

Ahmed Enany, the council’s chief executive and the report’s author, said the corridor had been growing steadily, and as of the end of last year was home to 117 companies, anchored by giant biopharma company Amgen Inc., which is headquartered in Thousand Oaks.

“Many of these companies resulted from people leaving or being laid off from Amgen,” Enany said. “People went and started up these companies nearby.”

Another key factor in the corridor’s ascendance, according to Enany, was the founding of local biomedical funding firm Westlake Village BioPartners in 2017 – the first private equity company aimed at biotech firms within the 101 Corridor.

“That’s been a qualitative change,” Enany said.

The region is expected to receive a further boost from a 350,000-square-foot research park being developed by Pasadena-based Alexandria Real Estate Equities at the site of Amgen’s old headquarters in Thousand Oaks.

But even with the expansion of the 101 Biomedical Corridor, Los Angeles County and Southern California as a whole still have a long way to go before emerging in the top tier of biotech and biomedical centers in the nation.

“The bulk of the money still gets sucked in by the Bay Area, followed by New York, Boston and San Diego,” Enany said. “But now, L.A. County and 101 Corridor definitely have moved into the top 10 centers of biomedical funding.”

The numbers

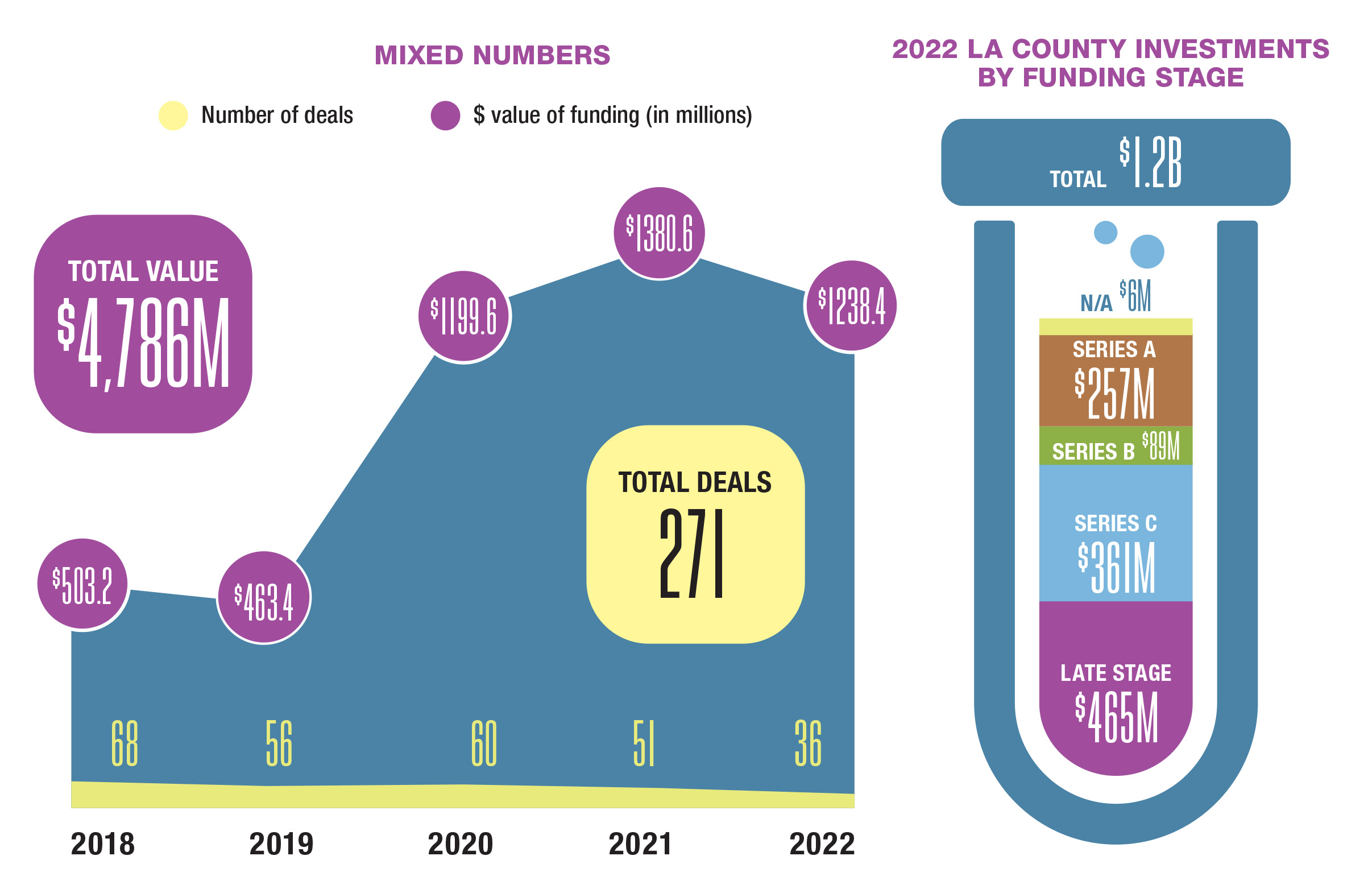

According to the Southern California Biomedical Council’s report, the number of biomedical companies in Los Angeles County that received private funding dropped to 36 last year from 68 in 2018. But the total dollar value of that private funding more than doubled, to $1.24 billion last year from $503 million in 2018. (The value actually dropped last year from a peak of $1.38 billion in 2021.)

That means the average size of a deal last year was $34 million, compared to just $7.4 million in 2018.

These larger investments were in later-stage companies (Series C and “late stage” rounds) that raked in $830 million in funding last year, nearly two-thirds of the total for Los Angeles County companies.

Much of this shift was due to the impact of the Covid pandemic, according to Enany. This was compounded at the end of 2021 and into 2022 by the shutting down of the public markets and rising interest rates.

“Covid and economic uncertainties following Covid caused investors to be more skittish,” Enany said. “And when you’re more skittish, you tend to place your money on more established companies, more sure bets, giving them enough to actually get their products to market.”