Amgen kept its revenue above analyst expectations for the third quarter in a row this year, clocking in a total of $6.65 billion fueled by record product sales.

“Our medicines generated 8% volume growth in the quarter globally, with 11 products achieving record quarterly sales,” Robert A. Bradway, Amgen’s chairman and chief executive, said in a statement. “This growth reflects the strong underlying demand for our medicines and the value they bring to patients.”

Sales for Evenity, a postmenopausal osteoporosis treatment, increased 35% year-over-year to a record $201 million for the third quarter. The record was driven by strong volume growth across markets, with domestic volumes growing 45% year-over-year and volumes outside the country the growing 30%.

Other products that recorded record quarterly sales included severe asthma treatment Tezspire, plaque psoriasis treatment Amgevita and blood disorder drug Nplate.

Amgen recently closed the acquisition of biotech company ChemoCentryx, which will add another product to its portfolio. The acquisition was completed for $52 per share in cash, representing aggregate merger consideration of approximately $3.7 billion.

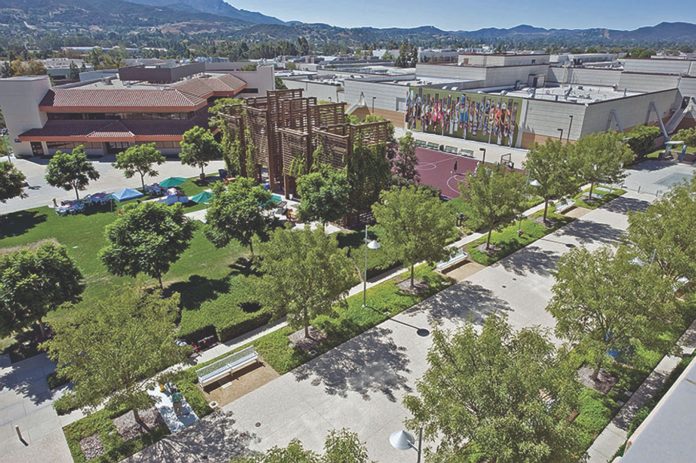

The Thousand Oaks company also beat earnings per share expectations by more than 5% with an increase to $4.70 driven by a decrease in operating expenses.

For the full year, Amgen expects to bear about $560 million in foreign exchange headwinds against product sales based on recent foreign exchange rates.

The company absorbed nearly $400 million through the third quarter.