Shares in Teledyne Technologies Inc. were helped by a strong third quarter earnings report.

The Thousand Oaks aerospace, marine and digital imaging products manufacturer saw its stock price get a 6% boost from a close on Oct. 22 of $443.49 to a close of $470.09 the following day after reporting its quarterly financials before the market opened.

It then climbed a fraction of a percent to close at $472.86 on Oct. 24, the highest amount in the last 52 weeks.

The share price closed at $455.32 on Oct. 31.

Teledyne reported on Oct. 23 adjusted net income of $241 million ($5.10 a share) for the quarter ending Sept. 29, compared with adjusted net income of $242 million ($5.05) in the same period of the previous year. Revenue increased by almost 3% from the third quarter of the prior year to $1.4 billion.

Most segments see increases

Out of the four business units of the company, three had increases in revenue.

Only digital imaging had a decrease in revenue. It went down by 1%, with net sales of $768 million, compared with $776 million in last year’s third quarter.

The third quarter net sales decreased primarily due to lower sales of industrial automation imaging systems and X-ray products, partially offset by higher sales of unmanned air systems, surveillance systems, infrared detectors and commercial infrared imaging systems, according to a Teledyne release.

The third quarter of 2024 also included $10.8 million of incremental sales from recent acquisitions, the release added.

George Bobb, the president and chief operating officer of Teledyne, said in a call with analysts from Oct. 23, that the instrumentation segment had an increase of 6.3% versus last year.

“Sales of marine instruments increased 24.1% in the quarter, primarily due to both strong offshore energy and subsea defense sales,” Bobb said. “Sales of environmental instruments decreased 3.5%, primarily due to greater sales of water quality instruments, offset by lower sales of select laboratory instruments and emission monitoring systems.”

In the aerospace and defense electronics segment, third quarter sales increased 9.2%, driven by growth in both commercial aerospace and defense electronics products, Bobb added.

“For the engineered systems segment…third quarter revenue increased 9.4%,” he said.

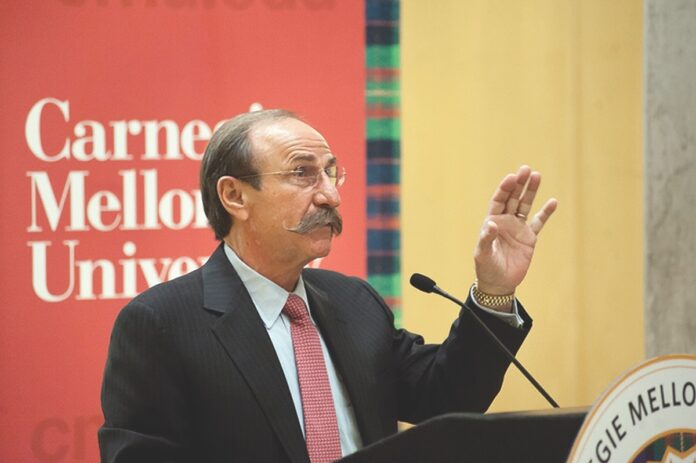

Robert Mehrabian, executive chair of the board, said during the call that over the last several quarters some of its markets have experienced weakness but that Teledyne lowered costs to protect margins in these businesses while growing and increasing margins in those businesses where the environment was more favorable.

Stock repurchases

During the quarter, the company also opportunistically purchased Teledyne stock. While its current $1.25 billion stock repurchase authorization remains active, the company is also fortunate that its near-term acquisition pipeline is healthy, Mehrabian said.

“While there are always new challenges, I’m optimistic that we have begun to exit some of our more difficult quarterly comparisons and we will continue to grow both organically and through acquisitions,” he stated.

Andrew Buscaglia, an analyst with BNP Paribas Exane in New York City, asked during the call about acquisitions

“M&A looks like it’s perking up here,” Buscaglia said. “Can you comment a little bit more on that? What are the size of these deals you might be seeing?”

Mehrabian responded that there hasn’t been that much opportunity for Teledyne to do acquisitions but that suddenly in the last month or so, the funnel has opened.

The company is seeing more opportunities especially outside of digital imaging companies to acquire, he said.

“So, we’re kind of positively inclined to look at what we can do, how much power we have to make acquisitions,” Mehrabian said.

Rather than focus on stock buybacks it is more likely that the company will focus on acquisitions as it has the wherewithal to spend up to $2 billion to $3 billion if it wants to, he continued.

“I don’t know if we’ll do that much, but we certainly are in the market to buy some smaller companies which would be, let’s say, in the $50 million range and maybe some things that are closer to $500 million or more,” Mehrabian added.

“It won’t be anything as large as Flir at this time, but there are many opportunities,” he stated.

Teledyne bought Flir Systems Inc. in May 2021 for $8.2 billion. The subsidiary develops cameras, sensors and drones used in military, industrial, automotive, marine and public safety applications.