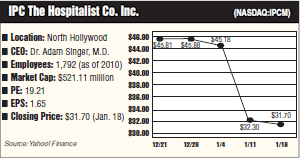

High-flying IPC-The Hospitalist Co. Inc., one of the best performing health care stocks, has fallen from its perch and is struggling to get back on top. Shares of the North Hollywood company plunged earlier this month on news of an earnings shortfall. But it was the company’s explanation for the miss — slower than expected growth in the number of patients under its care — that really spooked investors and has left them to wonder whether the company’s days of consistent high growth are numbered. IPC’s shares dropped 33 percent to $30.61 a share on Jan. 9, the first trading day after management announced that net revenues and earnings for both the fourth quarter and the full year 2011 would be at least 10 cents a share short of previously announced guidance. “It was a surprising drop and it’s the first time we saw this,” said Arthur Henderson, managing director and head of health care at New York-based Jefferies and Co. “All of us on Wall Street were asking ‘Wait a minute, what explains this engine suddenly falling from the sky?” After the market closed on Jan. 6th, IPC announced that patient encounters — its bread and butter — would be up by 22 percent to 1.22 million for the fourth quarter, a solid showing but significantly short of expectations. Those growth numbers have been in the high 20s range for a few years, analysts said. As a result of what it termed “unexpected softness in patient volumes,” net revenues for the full year 2011 were expected to come in somewhere between $455 million to $458 million, short of the previous guidance of $463 million to $465 million. The company expected full year earnings per share in the range of $1.70 and $1.74, significantly less than the guidance of $1.78 to $ 1.86. IPC staked out a niche in the growing business of hospitalist care 16 years ago when founder Dr. Adam Singer launched the company on the premise that doctors had less time to visit their patients in the hospital and that a hospitalist — a doctor who can coordinate a patient’s care while in the hospital — would not only improve the patient’s experience, but reduce overall costs by making sure the patient was dismissed in a timely manner. The company’s success has hinged on its ability to reduce patient length of stay and readmissions to the hospital, which it has done, fueling the company’s rapid growth in recent years. IPC has delivered year-over-year revenue growth of close to 30 percent in recent years. In addition to organic growth of about 20 percent a year, the company delivered an additional 10 percent year over year growth from buying hospitalist practices nationwide, said Brooks G. O’Neil, senior research analyst at Minneapolis, Minn.-based Dougherty and Co. Investors now fear that the days of such fast growth are coming to an end even as IPC’s costs rise. That fear is not unjustified. Health care spending in 2010 grew by just 3.9 percent, according to a recent report from the federal Department of Health and Human Services, the slowest rate of growth in 51 years. The slowdown — a function of both the lagging economy and successful efforts to curb skyrocketing health care costs in recent years — is good for the federal budget, but affects admission rates at hospitals, which are down across the country. It could also be affecting IPC’s rate of growth. Declining hospital admissions means less work for hospitalists who care for those patients. Indeed, the very factors that contribute to IPC’s success and high growth rate — its ability to drive down patient length of stay and hospital readmissions — could be what’s now contributing to the slowdown in patient encounters, and ultimately, revenues. Former IPC Chief Financial Officer Devra G. Shapiro, who is currently chief administrative officer, acknowledged that that might be the case. “That’s more of a macro trend that would not typically affect us quarter to quarter,” Shapiro said. “But certainly it’s true that shorter lengths of stay and fewer readmissions to the hospital leads to declining encounters.” It’s also a significant reason why IPC entered the post-acute care market of skilled nursing homes and rehabilitation facilities, she added. Shapiro said roughly 15 percent of IPC revenues now come from hospitalists working in these facilities while 85 percent is from acute care centers. IPC executives said they are unsure why patient encounters came in below expectations for fourth quarter. “We saw the softness in certain practices…we knew anecdotally that at several facilities the census was down, but we don’t know which ones and we don’t know if it was across our whole portfolio,” said Shapiro. “We are digging in now to see what happened.” While management took pains to explain that the announcement was not its official earning release but a “pre-announcement” that they wanted to issue ahead of an investor’s conference, Wall Street punished the stock. As bad as the possibility of a slowdown in growth, the notion that management didn’t have all the answers was even worse, analysts said. “It was a little disturbing that we don’t know why this happened,” Henderson said. “We understand they were forced into issuing information because of the conference. But in the environment we are in, with volatility being what it is, investors sell and ask questions later.” Indeed, the stock dropped in after-hours trading from a high of $45.65 only to open Monday morning at $34.54, sliding to $30.61 by the end of business that day. It closed at $32 a share on Jan. 19. The selloff was also fueled by the fact that this was IPC’s third quarterly miss, said Kevin Campbell, senior research analyst who follows IPC for Nashville, Tenn.-based Avondale Partners. IPC missed its earnings projections in both the second and third quarters, he said. “On the last conference call they said they made changes … so it was a surprise to see some of the same problems yet again.” Other factors that hurt earnings were higher than expected start-up costs for hospitalists trying to establish brand new practices, IPC said. These are often new doctors, some fresh med school graduates with little experience, who need time to develop patient referrals, she noted. Shapiro said these new practices were an investment in the future and that in time, the new doctors will prove more productive. She did say that in some parts of the country, it is taking hospitalists longer to build a patient base. IPC also faced high temporary staffing costs in the fourth quarter, which when combined with slowed revenue growth, hurt profits. Turnover in permanent staff at some hospitals forced the company to hire much more expensive temporary doctors, the company said. These doctors are 2 to 2.5 times more costly on a per diem basis than staff doctors, Shapiro said. “Those practices have been staffed up with permanent doctors now,” Shapiro said. In addition, she said, the company is cutting loose hospitals that refuse to pay the higher temporary staffing costs. “They’ll have to pay the higher cost or we’ll get out of those contracts,” she said. Immediately following the selloff, Campbell and others downgraded the stock from a buy to a hold. “I can’t recommend the stock until they prove that some of these issues will normalize,” Campbell said. Analysts said the company’s current share price in the low $30 range is more indicative of IPC’s value with a price to earnings ratio of about 16 times projected 2011 earnings of $1.70 a share, and reflects slower projected growth of 15 percent to 20 percent next year. “They had a very high P/E ratio that reflected aggressive growth,” Henderson said. “When the growth disappeared, so did the multiple.”